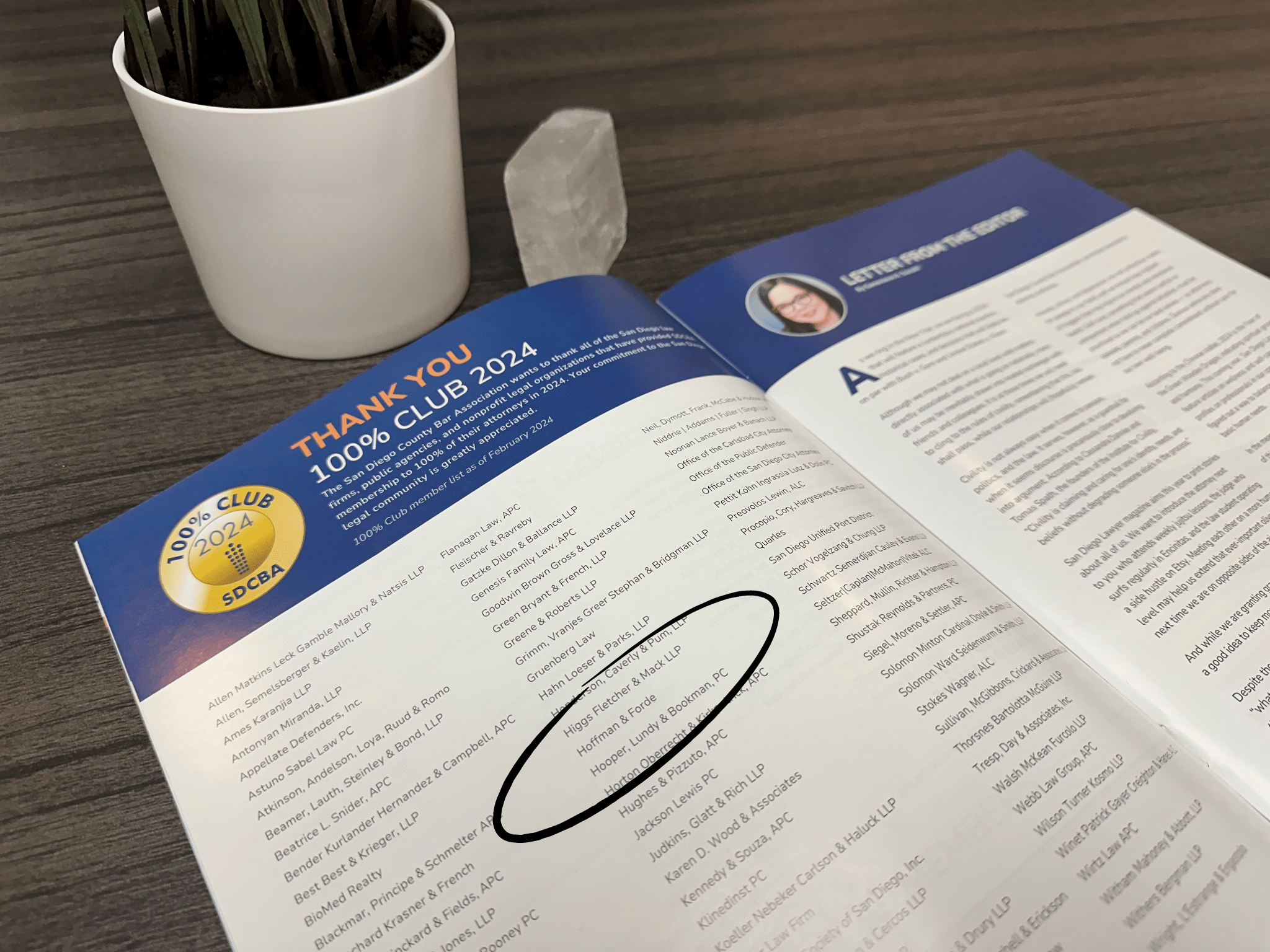

At Hoffman & Forde, we take pride in the fact that each of our attorneys is a member of the SDCBA. Their longstanding and steadfast commitment to this organization sends a powerful message about the immense value the San Diego County Bar Association holds within the legal community

SDCBA is acknowledged as the anchorage point of San Diego’s legal landscape, and the association has done this by developing and upholding excellent legal standards as well as by sustaining an overwhelmingly fair justice system for all attorneys and the common public.

This article examines two important things – SDCBA’s instrumentality and its benefits to the community.

Recognizing the San Diego County Bar Association

Established in 1890, the SDCBA has a long tradition of upholding the principles of professionalism, justice, and legal services through the provision of affordable legal services. It is simply a professional association established to support and empower attorneys in San Diego and in the process enriches the lives of the community.

Key Services Offered by the SDCBA

- Lawyer Referral and Information Service (LRIS) – by connecting residents of San Diego and competent attorneys, this program fills the gap by assuring that their rights are represented.

- Continuing Legal Education (CLE) – the SDCBA provides extensive training programs accommodating to the lawyers who wish to stay informed of recent judicial updates and to maintain the superior standard of competence.

- Public Service Initiatives – service Delivery Centers is devoted to enriching the lives in the community by means of volunteer free legal help, educational programs and constant support for the numerous legal aid organizations.

- Professional Ethics Resources – the SDCBA offers lawyers the resources and advice which they need to handle their ethical practice and maintain the standards of professional responsibility until the highest level.

Why the SDCBA Matters

SDCBA stands out by being one of the major institutions that are connecting legal professionals and the community of San Diego. Its contributions benefit both legal professionals and the public by:

- Preserving the highest professional ethics and values of lawyers in the legal field.

- Proper support of lawyers to accumulate their knowledge and keep it up to date through consistent training.

- Enabling the public to obtain legal advice and representation from appropriate qualified attorneys and legal scholars.

Conclusion

The San Diego County Bar Association serves as a pillar or cornerstone in our society. By recognizing the hard work and dedication of lawyers in San Diego, we send a message that the flourishing of a quality legal system is paramount.

Need Legal Advice?

If you are facing a legal situation in San Diego County, the resources offered by the SDCBA can be a valuable starting point.

Additionally, Hoffman & Forde, Attorneys at Law, is here to assist you with your legal needs. Contact us today for a consultation at (619) 546-7880 and our intake specialist will converse with you and collect the essential information needed to assess your matter.

Recent Comments